In recent discussions across Philippines community, a consistent theme has emerged: the US Dollar appears to be getting stronger against the Philippine Peso. While this might seem like a straightforward observation, a deeper analysis reveals a more complex narrative. Many experts suggest that this trend is less about an inherently robust US Dollar and more about a weakening Philippine Peso. This comprehensive exploration will dissect the forces driving this currency dynamic, its widespread impacts, and what it means for various stakeholders.

Is It a Strong Dollar or a Weak Peso? Unpacking the Core Dynamics

The initial sentiment that the USD is gaining strength is widely shared. However, a closer look at the broader currency landscape suggests a significant part of this phenomenon stems from the Philippine Peso’s declining value. This perspective is crucial for a nuanced understanding, as it shifts the focus to domestic economic factors within the Philippines.

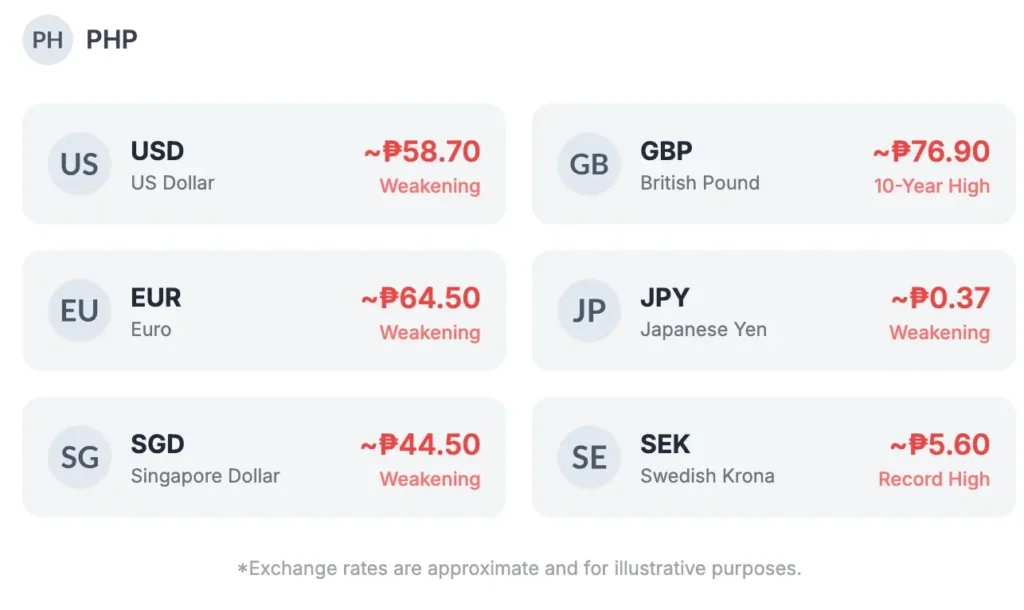

Evidence of the Peso’s weakness is not limited to its exchange rate with the USD. Other major currencies have also seen considerable gains against the PHP:

- British Pound (GBP): The British Pound recently reached a 10-year high against the Peso. Notably, it climbed to 76.9 pesos per pound, a significant increase from 61 pesos in 2022.

- Euro (EUR): The Euro has similarly strengthened, with exchange rates observed at 64.5 pesos per Euro, up from 62 pesos in February.

- Japanese Yen (JPY): The Yen has also gained ground, with 10,000 JPY exchanging for 3,944 PHP, compared to 3,820 PHP just a month prior.

- Singapore Dollar (SGD): The Singapore Dollar stands at 44.5 against the Peso.

- Swedish Krona (SEK): The Swedish Krona is also reaching record highs versus the PHP, further indicating a broader trend of Peso depreciation.

This consistent trend across multiple major currencies strongly suggests that the primary driver is indeed the weakening of the Peso rather than a universal surge in the strength of individual foreign currencies. Historically, there are even recollections of the Pound being as high as 1-100 against the Peso. It’s also worth noting that the Peso tends to exhibit seasonal fluctuations, typically being at its weakest around June and peaking in December.

Read also: Best Way to Send Money From USA to Philippines

Deciphering the Economic Levers: Why the Peso is Weakening

Several interconnected economic factors are contributing to the Philippine Peso’s current depreciation:

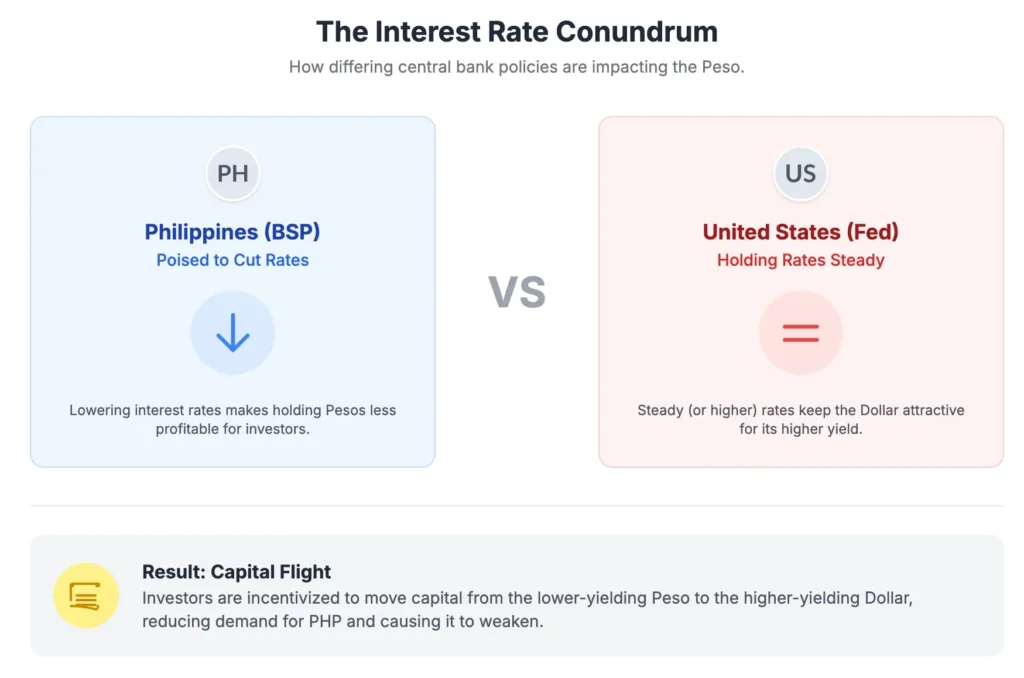

1. Divergent Monetary Policies: The Interest Rate Conundrum

A significant factor underpinning the Peso’s weakness is the divergence in monetary policy between the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve (Fed). The Bangko Sentral is reportedly poised to cut interest rates. In stark contrast, the US Fed is showing no immediate signs of rate cuts; despite earlier “dot plot” projections of potentially four cuts this year, current expectations lean towards at least one, or even zero, rate cuts.

This disparity creates a crucial imbalance. Higher interest rates typically attract foreign investment by offering better returns on capital. When the BSP cuts rates while the US Fed holds steady or delays cuts, the Peso becomes less attractive to international investors seeking higher yields. This reduced demand for the Peso contributes directly to its depreciation.

2. Gold Sales: A Strategic but Impactful Move

Another factor highlighted is the Philippines’ position as a significant net seller of gold. In 2024, the country disposed of a substantial 29.4 tonnes of gold. While the motivations behind such sales can be complex (e.g., shoring up foreign reserves, managing liquidity), some analyses suggest that this could contribute to the Peso’s long-term decline. The sale of a country’s gold reserves can sometimes be perceived as a sign of economic stress or a move that reduces the underlying asset backing of its currency, though currency markets are influenced by many factors.

3. Geopolitical Speculation

While less concretely defined in the sources, some community discussions also point to the possibility of a “looming conflict” as a contributing factor to the Peso’s struggles. Such geopolitical uncertainties can often lead to capital flight and a weakening of local currencies as investors seek safer havens.

Domestic Economic Challenges: The Philippines’ Internal Pressures

Beyond global monetary policy and asset sales, internal economic policies and structural challenges within the Philippines are exerting significant pressure on the Peso and the broader economy.

The Rice Importation Conundrum

A critical issue is the Philippines’ reliance on rice imports. Despite being an agricultural nation, the Philippines is the world’s top importer of rice. Domestic production is insufficient and not cost-competitive enough to meet the demand. Consequently, the government imports large quantities—4.7 million tons last year alone—primarily from countries like Thailand, Vietnam, and China, to control inflation and ensure food security.

The Perils of Price Controls

This reliance on imports is exacerbated by what some describe as problematic government policies related to price controls. Specifically, price controls are imposed on domestically produced rice at both provincial and federal levels. Economically, price controls are widely understood to distort markets and are often ineffective. In this case, these controls disincentivize local farmers, who, facing business losses from the mandated low prices, choose to export their rice abroad.

Subsequently, the Philippines then imports rice back into the country at a higher, uncontrolled price. This cycle not only undermines domestic agriculture but also places consistent pressure on the Peso by increasing the demand for foreign currency to pay for imports. Critics argue that such policies are more about “virtue signaling” than genuinely aiding the populace, leading to significant financial harm to farmers under the guise of helping the poor.

This combination of insufficient domestic production and economically unsound price controls creates a structural demand for foreign currency, weakening the Peso and making essential goods more expensive.

The Ripple Effect: Who Wins, Who Loses?

The weakening of the Peso has disparate impacts across various segments of society, creating clear “winners” and “strugglers.”

For Expats and Remote Workers: More Bang for Your Buck

For individuals earning in stronger foreign currencies, particularly the US Dollar, the weakening Peso translates directly into increased purchasing power in the Philippines. If you’re doing remote work for a US job while residing in the Philippines, this means you get “more bang for your buck” as your conversion yields a greater amount of pesos. Essentially, your effort and earnings are worth significantly more value when paid in USD within the Philippines. This can make living expenses, leisure activities, and even investments in the local economy more affordable and attractive.

You may like: Average Salary in Philippines

For Local Filipinos: The Burden of Rising Costs

Conversely, the weakening Peso presents substantial challenges for the majority of Filipinos whose income is denominated in the local currency. For those with “Filipino jobs,” the value of their earnings effectively diminishes. The most immediate and painful impact is the rising cost of imported goods. As the Peso weakens, it takes more Pesos to buy the same amount of foreign currency needed for imports.

This affects fundamental necessities:

- Fuel prices surge, directly impacting transportation costs and the price of goods across the supply chain.

- Rice prices go up, a particularly sensitive issue given its status as a staple food and the country’s reliance on imports.

Ultimately, these rising costs disproportionately affect the poor, making them “even poorer”. The economic strain can also have broader societal consequences, with some discussions linking it to potential increases in crime.

Related: Cost of Living in Philippines

Navigating the Future: Considerations and Outlook

Predicting currency movements is notoriously challenging , but the current trends offer clear insights. The consistent depreciation of the Peso against multiple major currencies, driven by both global monetary policy divergences and domestic economic challenges, suggests that the current environment of a stronger USD (relative to PHP) is likely to persist in the near term unless significant policy shifts occur.

For those managing finances in the Philippines, understanding these dynamics is crucial. While it’s difficult to forecast exact figures, a pragmatic approach for budgeting might involve considering a higher exchange rate, perhaps rounding to 50 pesos per dollar as a general guide, to account for potential further depreciation and provide a buffer.

The current currency landscape underscores the complex interplay of global finance and local economic policy. For expats, it presents an advantageous living situation, but for the majority of the Filipino populace, it highlights the urgent need for robust and effective economic strategies that strengthen the domestic economy and stabilize the national currency.